GM Hydraheads,

In our previous post, we highlighted how short-sightedness and poorly made design choices allowed the spread of some contagious events in the DeFi space. At this pivotal (some say existential) moment, the only way forward for DeFi is to realign its value proposition with the need for a sustainable protocol design.

A key element of any sustainable protocol design is having a balanced value proposition. Projects must be able to balance out the long-term interests of their various stakeholders. Offering a 3-digit staking APY at the expense of diluting existing token holders can hardly be sustainable. Sustainability is only possible when the scales are in balance.

We already pointed out that the design of the Omnipool - which combines all liquidity into a single AMM, brings unprecedented capital efficiencies. While this is obviously great news for traders, our post left a crucial question open: Does it come at the expense of LPs or HDX hodlers?

This article delivers the missing piece of the puzzle. It presents the design choices we have made to make sure that LPs are rewarded for their commitment, while ensuring HDX hodlers can remain comfy hodling and not asking “muh governance token?”.

Together with the piece on economic efficiencies, this post ties up the HydraDX value proposition for all three groups of stakeholders: Traders, LPs, and HDX Hodlers. As you will see, here at HydraDX, we strive to ensure that the incentives towards any one group of stakeholders do not jeopardize the interests of the others. Instead of cannibalizing each other, Hydraheads support each other and make sure each other gets fed.

A Game Theory for Liquidity Providers

While HydraDX has been fortunate enough to bootstrap a generous amount of Protocol Owned Liquidity (22.9M DAI) - part of which will be deployed to the Omnipool as initial liquidity, Liquidity Providers (LPs) remain key to the healthy and sustainable development of our Protocol.

As such, finding ways to responsibly incentivize LPs is important to the Omnipool’s success. The strategy we have devised consists of a mix of measures which reward commitment while mitigating deterrents (Impermanent Loss).

Rewarding Commitment

First and foremost, providing liquidity to the HydraDX Omnipool should be worth it, also in the long term. In other words, the design of the protocol must render LPing as an economically attractive option. To achieve this, we have prepared a series of positive incentives.

The innovative design of the Omnipool - which combines all different tokens into a single trading pool, opens the possibility of single-sided liquidity provisioning. This is much more capital efficient as compared to the traditional model of XYK pools (pairs of tokens) where LPs need to provide liquidity equally for each token in the pool.

To ensure that LPing into the Omnipool is not only more efficient but also profitable, we are setting up several layers of rewards. At the most basic level, every LP receives rewards from the asset fees generated by trades with the provided asset.

The upcoming Hydrated Farms build the second layer on top of rewards from fees. These farms represent liquidity mining programs of set duration which incentivize LPing into specific assets. What makes Hydrated Farms special is their focus on commitment and sustainability. Thanks to the built-in loyalty factor, the rewards from Hydrated Farms grow over time as the provided liquidity remains in the Omnipool.

The second layer of rewards from Hydrated Farms can be financed in several ways, depending on the incentivized asset. In the first place, we have reserved a generous share for Liquidity Mining rewards as part of the HDX tokenomics. However, our design of the Hydrated Farms also allows the incentivization of specific assets with different tokens than HDX. In other words, farmed rewards are stackable, and any Hydrated Farm can be incentivized by more than one token. This allows Polkadot projects to join forces by allocating some amount of tokens from their treasuries to create some Super Hydrated Farms!

Mitigating Deterrents

As you already know, our design of the Omnipool concentrates all liquidity in a single AMM, thereby unlocking unparalleled capital efficiencies along with the possibility of single-sided liquidity provisioning. This, however, still does not address the elephant in the room: Impermanent Loss (IL), which remains arguably the most important deterrent for any LP to provide liquidity to AMMs.

As part of our value proposition, the HydraDX protocol has been working towards a sustainable strategy to better manage the effects of IL. To achieve this, we have developed a mechanism for socializing some of the impermanent loss.

Socializing Impermanent Loss

Unlike traditional XYK pools, all assets in the Omnipool are valued against the same asset (LRNA) which gets minted or burned to reflect changes in liquidity. A convenient byproduct of this is that the protocol is now able to fairly distribute IL across the whole basket of assets. In other words, an LP of a volatile asset may not necessarily have to endure the entire amount of IL. Instead, some (but not all) of this IL may be distributed across all LPs. This is the first aspect of socializing IL.

The second aspect of socializing IL is the partial compensation in LRNA. When an LP seeks to exit a position which has suffered IL, the amount of tokens they will receive may be less than what was initially deposited. In such situations, the protocol will offer some LRNA to the LP who exited the pool. The LP may decide to sell the LRNA back to the Omnipool in exchange for their token of choice. Note, however, that this does not equate to IL protection. Instead, the compensation simply aims to ensure that IL is fairly distributed among the LPs.

The decision to provide partial compensation in LRNA as part of the scheme for socializing IL may rightfully raise the concern of a possible death spiral, similar to what happened with Bancor’s IL protection mechanism. It should be pointed out, however, that there are several key differences between our mitigation mechanism and the IL protection mechanism of Bancor.

To begin with, LRNA is only used to paritally compensate IL, and the LRNA tokens in question already exist, meaning no new minting occurs as part of the compensation. Furthermore, we have put several stabilization mechanisms in place to help prevent any potential downward spirals of LRNA.

LRNA Stabilization Mechanisms

The first LRNA stabilization mechanism is a Protocol Fee. When a trade occurs in the Omnipool, two types of fees may be collected: an Asset Fee and a Protocol Fee. The Asset Fee is simply the trading fee paid to LPs (similar to other AMMs). The Protocol Fee, on the other hand, is economically embedded to help absorb some of the sell-pressure from LPs via supporting the value of LRNA.

Whenever LRNA is sold back to the Omnipool, the accumulated Protocol Fee would be activated to burn LRNA until ~2x the amount of LRNA sold back is burnt. This provides an interesting game theory dynamic as the Protocol Fee helps support the price of LRNA.

To note again, this is different from Bancor’s IL compensation. The Protocol Fee is generated from trading activity and is not tied to either LRNA or HDX. Hence, the burn pressure will always resume as long as the Omnipool is used. Therefore, panicking or selling when the LRNA price temporarily fluctuates is not optimal for LPs. Hence if LPs wait to sell back LRNA only when it is at par or at a premium, they would likely see their IL naturally decrease over time.

A second LRNA stabilization mechanism is the HydraDX Protocol Owned Liquidity (POL). In the long term, POL will help cushion the volatility of individual LP actions (withdrawals) by ensuring that a base level of liquidity remains within the Omnipool, thereby helping prevent bank run-like scenarios. Over time, the protocol will be building up POL thanks to upcoming bond purchase programs and our socializing IL strategy (in cases of liquidity withdrawals with impermanent gain).

A final stabilization mechanism to note are the liquidity restrictions placed at the Omnipool’s mainnet launch. Firstly, LRNA will not be directly purchasable at the beginning, with IL compensation being the only way to obtain the token. Furthermore, there will be a cap for any liquidity add operation as a safeguard against potentially toxic assets which may cause the excessive minting of LRNA. These caps will also be asset-specific and will cover all assets, including HDX.

As we continue evolving, the protocol will be observing the functioning of the mechanisms outlined above and adjust them as we test and add new features.

Game Theory for HDX Hodlers

HDX Hodlers are our most committed group of Hydraheads, having supported the project since day one, long before our vision for borderless liquidity was fully crystallized. As such, creating another simple “muh governance token” would not do them justice. For that reason, we have devised several mechanisms to keep HDX hodlers hydrated.

To begin with, we ensured that protocol operations do not dilute HDX hodlers. Our choice for a 2-token model allows the pool token LRNA to absorb all fluctuations in the liquidity provided to the Omnipool. Furthermore, HDX is not used to economically support the price of LRNA, preventing a LUNA/Terra-like scenario.

Besides this design safeguard, we have put two mechanisms in place for HDX value accrual. The first mechanism is our Protocol Owned Liquidity (POL) which HDX hodlers have fully at their disposal (through governance). Already standing at 22.9M DAI, HydraDX’s POL will gradually build up over time thanks to future bond purchase programmes and strategy of socializing IL . This ensures HydraDX’s POL will continue to make up a meaningful share of the LP assets in the Omnipool, offering unprecedented stability for an AMM.

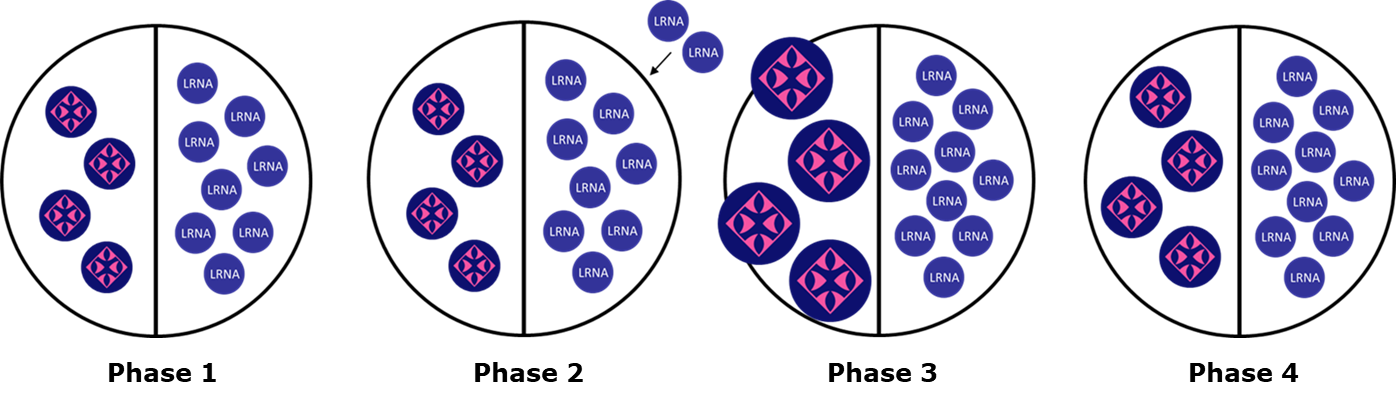

The second value accrual mechanism is translating excess LRNA demand into direct value accrual for HDX. In cases where demand for LRNA exceeds what is viewed as optimal for the health of the protocol, the protocol will automatically start a slow but relentless minting of LRNA into the HDX pool. Assuming LRNA’s price remains relatively static, this increase in the amount of LRNA will gradually cause the price of HDX to increase. The process consists of four phases which are briefly described below.

Phase 1 – Initial State

In the example above, the HDX / LRNA synthetic pool is balanced at 2:1 at the beginning.

Phase 2 – LRNA Minting

The protocol observes that the amount of LRNA in the Omnipool has surpassed the optimal level. Therefore, LRNA is slowly minted and added to the HDX / LRNA synthetic pool, causing an imbalance as LRNA’s value within the pool is greater than that of HDX’s value.

Phase 3 – Overvalued to Market

To rebalance the pool back to 50/50, the price of HDX is now increased (as the supply remains unchanged).

Phase 4 - New State

Arbitrageurs see HDX is now overvalued relative to all other TKNs in the Omnipool as denominated in LRNA. They swap HDX for any other TKN to rebalance this ratio, resulting in a new, slightly higher price for HDX.

Conclusion

The design of the HydraDX Omnipool has a reasonable value proposition which hits every Hydrahead with skin in the game - traders, LPs and HDX hodlers alike. While parts of it may still sound very abstract, we are much closer to reality than some may think.

With both development of Omnipool v1 and the rigorous audit complete, we are currently in the process of addressing some minor points of the audit (meaning that no major / design flaws were found). Once this has been completed - together with ongoing work on the front-end, we will be ready to launch the public testnet cycle.

As the HydraDX Omnipool comes lurking around the corner, redemption for AMMs is close. To make this final wait more bearable, we will be releasing a series of blog posts called Hydralosophy which takes a deeper look under the hood of HydraDX. The aim of the series is to share and explain our web3 vision, touching on fundamental considerations we have made along the way such as: Why our own blockchain, Why Polkadot, Bridges vs XCM etc.

Until then,

Stay on top of liquidity.

– HydraDX