In recent months a small community has emerged around HydraDX. It was all very organic. Our marketing budget has been exactly 0. We are grateful for this support. After months of development and raising funds to launch the network, we have arrived at a point at which we are overdue with some very important answers.

With the first “Wen token?” that appeared in our Telegram/Discord group, we could not wait to share the following with people interested in HDX. But all in due time.

Let’s be real. The token is a crucial element for HydraDX protocol. Its technical importance aside, it is the glue that holds the community together. Not all of you are here just for our great tech (ahemCMSahem). Based on our observations, some of you are here for the opportunity to own the asset that makes our great tech even greater.

From early on we knew that if we want to create the best liquidity protocol out there, the asset that will act as a binder must be superb. To become a great asset a token must fulfill the following criteria:

Meaningful value accrual - if our protocol creates and captures value, it needs to be directed to those token holders, who are actively participating to the success of the protocol (no freeriders)

Utility - the token needs to serve a meaningful purpose that enhances the protocol and doesn't create friction

Hardness (not a freebie) - we don't subscribe to short term yield games propelled by “valueless” governance tokens being dropped to anyone who passes by, our token is valuable and we treat it as such

Optimal distribution - one of the big early challenges for every decentralized protocol is making sure that the ownership is distributed into the hands of a wide community of those who care for the long term success of the project

We let others assess whether that has been achieved. In this article, we will explain our plan to achieve #4.

The Optimal Distribution

The meme of fair launch dominated the summer of 2020. We do not know what fair actually means but it is probably akin to that saying about greed - “It’s the other fella who is greedy”. Fair is relative. Fair to some is unfair to others. HydraDX does not compute fair. Our goal is to go for optimal. You can judge for yourself whether it is fair.

The goal is to achieve technical and cartelization resilience. This must be as high as possible for aspiring leaders in crypto liquidity processing.

Our early backers committed substantial resources up front for HydraDX to become what it is. This was before DeFi was the talk of the town. This is not a fork with a food emoji attached nor a simple smart contract that can be launched over a weekend.

Given that funds were committed before any notion of coming success, the company tasked with launching HydraDX receives 15% of total token supply. That is; both investors and founding team will receive combined 15%.

The rest (85%) is reserved for anyone who wants to participate.

The industry standard has become private investors, founders and other insiders gobbling up 40%-70% of the supply. Such concentration is suboptimal, making “decentralization” in the future an obscure future vision.

We believe that to build a sustainable protocol the community must prosper together. This is the safest way to achieve relative decentralization early on and not making it a distant vision. We believe it is not that hard, we just need to pave our own way instead of copying what others are doing.

Crypto’s departure from “hardness” (of money) was fast because it was convenient. We could have made it easier for ourselves. We do not want to. We are here for the long run. If HydraDX is meant to stay here it must survive this test. Rewarding yourself with millions at the beginning just prolongs death. We want to fight to live.

We play on nightmare difficulty. Will you play with us?

The founding team of HydraDX are not meant to be the only builders. We need the community early on. More eyes can spot more flaws, more brains can come up with better solutions. There is no silver bullet for doing the distribution right, but based on our research and observations we came up with a multistep plan for gradual decentralization, incentivization of early (but also not-so-early) participants and anyone contributing useful work, liquidity or both.

That is our idea of optimal distribution.

Balancer Offering: Liquidity Bootstrapping Pool (LBP)

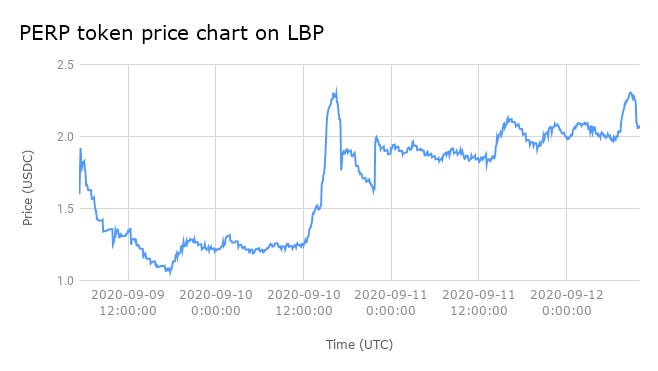

Main advantages of LBPs over the Uniswap listing is a choice of various ratios that do not restrain us to 50:50. It also offers additional programmability e.g. falling initial price with continuous sell pressure from smart contracts that prevents furious front-running by bots and whales leading to insane price pumps and suboptimal distribution.

These features predict better distribution and optimal price discovery mechanism. The results of this mechanic that was pioneered by Perpetual Protocol are pictured below.

The main objectives of HDX distribution are to (1) conduct an initial price discovery, which helps us set up our native liquidity pool at mainnet, and (2) publicly distribute part of the supply ~5% to HydraDX community (in LBP).

All funds that will be exchanged for an ERC20 representation of HDX (let’s call it xHDX) will be moved to the HydraDX protocol pool. This will become the initialization liquidity as soon as bridging Ethereum and Polkadot technology allow it. xHDX LBP really is a means to distribute rather than a sale. The only beneficiary is the pool and protocol itself.

This is not a token sale. It is a claim on the future of a network that may be bootstrapped to existence. No entity is using the proceeds from the LBP. All funds that will be exchanged for xHDX will become the initialization liquidity of the HydraDX protocol liquidity pool and remain in the ownership of the network.

Once the chain is ready a Stakenet period begins with a one way bridge from ERC20 HDX representation to a Substrate native HDX. On the native Substrate chain, HDX holders will be able to stake and receive rewards. (The rewards from HDX staked by founders & investors at this stage will go towards on-chain treasury)

Additional ~5% will be claimed in this Stakenet & Incentivized Testnet Period. These rewards will be used as a stress test of maximum number of validators, transactions and other parameters and allow holders to receive additional HDX. We also need to use this period for bootstrapping HydraDX validator sets.

This mechanism pioneered by Cosmos has proved itself as a very useful approach for launching and stress-testing the new Proof of Stake networks. Before we can launch HydraDX mainnet we need to be sure that all features are working as intended and every critical bug was discovered either by the community or via a professional audit. (We prod in test)

The exact specifics on xHDX LBP will follow soon.

To Summarize

The current roadmap looks as follows but things are subject to change:

Rococo Testnet [Hydrate]

ERC-20 xHDX LBP

Stakenet (xHDX → HDX)

Incentivized Testnet

Interchain Incentivized Testnet

Kusama “Chaosnet” [Basilisk]

Mainnet Launch

The planned HDX distribution looks like this:

5% LBP on Balancer

5% Stakenet & Incentivized Testnet rewards

15% founding team & investors (locked, stake-able)

75% liquidity mining & staking rewards

How do we fund the treasury?

Given that founder and investor tokens are going to be staked during the Stakenet & Testnet phase, we will use these staking rewards from the Stakenet to fund the protocol treasury. This only applies to founder & investor tokens. After a couple of months we expect that roughly 1% of the total supply will end up in the treasury. The treasury will be used to fund HydraDX development and community efforts.

How to approach liquidity mining?

The goal is to create a sustainable economic model that enables HydraDX to achieve long term plans. The liquidity incentive scheme will be modelled to support these plans and goals. Details will be announced soon. We expect a community discussion around this as well.

Wen token ser?

The goal is to do the LBP sometime in early February, pending technical setup. The exact date will be announced through *our official channels only* with a week’s notice - everything else should be considered a scam. The stakenet should follow closely after that.

We understand that although it is the team’s responsibility to achieve technical brilliance, the community does its own share of heavy lifting. A liquidity protocol without liquidity is nothing. An open and decentralized liquidity protocol without a diverse community of dedicated stakeholders is nothing.

We believe that people who will claim their stake in the future of HydraDX are people who are actually willing to help us deliver. The following weeks will be exciting. We can't wait to see you all bootstrapping the liquidity to breathe life into the future multi-headed monster of liquidity.

The best ideas are yet to be shared. In the meantime stay hydrated, not liquidated.

Our official channels:

🦸♀️Telegram Channel