Welcome to the HydraDX Monthly Update, where you can keep track of all things HydraDX.

Please note the dates for our upcoming quarterly AMA Office Hours taking place this week on the HydraDX Discord:

October 12th, 3pm UTC (8am/11am PST/EST; 11pm HKT/SGT)

October 12th, 7pm/10pm PST/EST (10am HKT/SGT - October 13th)

For those who are unable to attend Office Hours, there will be two 1-hour text-based AMA sessions occurring:

Chinese - October 12th, 9pm HKT/SGT (in WeChat)

English - October 13th, 11am UTC (on Discord)

Autumn Breeze of Updates

Greetings! As the winds of change blow in September, we welcome the new season with open arms. Though summer's warmth may fade, innovation continues flourishing across the Polkadot ecosystem.

These past months, HydraDX pushed boundaries by integrating groundbreaking features that reinforce our role as the go-to DEX on Polkadot. Our integration of Moonbeam Routed Liquidity established HydraDX as the first parachain leveraging this powerful functionality. We will also soon go live with native USDC, enhancing liquidity and usability. And lastly, our long-awaited HDX staking program launched, incentivizing governance activity that benefits the HydraDX Protocol.

Below you'll find details on these new features, updates on our ever-expanding Omnipool, and an insightful Kusamarian podcast interview with some of our Hydrators. As the leaves turn and the air cools, we welcome your feedback in Discord on how HydraDX can continue improving.

Now let's dive into the updates and sail into the new season! 🐉🍁

Key Protocol Updates

Moonbeam Routed Liquidity to HydraDX [LIVE]

Previously in August, HydraDX became the first parachain to leverage the groundbreaking Moonbeam Routed Liquidity (MRL) feature. With MRL, the entire Polkadot ecosystem can tap into billions of dollars in liquidity via the Wormhole protocol. This means HydraDX users can now seamlessly bring in crypto liquidity from ecosystems like Ethereum, Solana, Polygon, or Avalanche without the need to create a Moonbeam account or interact with Moonbeam directly.

As the pioneering parachain on Polkadot to utilize Moonbeam Routed Liquidity, HydraDX users can swiftly move Wormhole-based tokens in and out of our ecosystem using Carrier's user-friendly interface — a powerful token and NFT cross-chain bridge for crypto natives.

Try it out here: https://www.carrier.so/

At the moment, assets that have been bridged over via Moonbeam include: wETH, wBTC, and DAI; as part of an ongoing effort by HydraDX to diversify and provide additional liquidity routes for users. To date, the protocol has already completed 4 batches of OTC orders (latest one last week) for this transition. Learn more about the initial proposal and ongoing discussions here: wormhole migration (pt 2) and diversification of MRL.

USDC on Polkadot [LIVE] and Stableswap soonnnn

Native USDC is now registered on HydraDX, further cementing Polkadot as one of the go-to DeFi ecosystems in crypto!

With our upcoming launch of StableSwap — an efficient algorithm for trading stablecoin assets, HydraDX will provide a first-on-Polkadot low-slippage and capital-efficient trading experience for native stable assets like USDC and USDT.

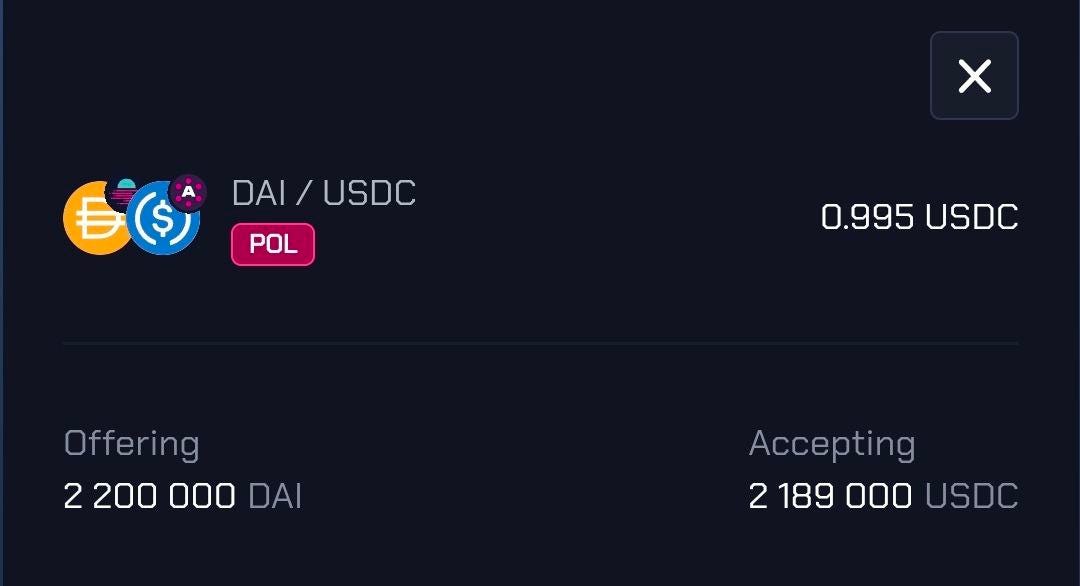

To kickstart the growth of native USDC liquidity, the HydraDX protocol is incentivizing the community to help it diversify into USDC using OTC orders. Currently, there are open orders seeking to swap 2.2M bridged DAI for native USDC at a 0.5% premium.

Through this bootstrapping of native USDC liquidity, HydraDX will further its goal to becoming the de-facto liquidity blackhole for native USDT (#1 TVL currently in the ecosystem) and USDC on Polkadot.

Support us in bringing 💦: https://app.hydradx.io/otc

HDX Staking [LIVE]

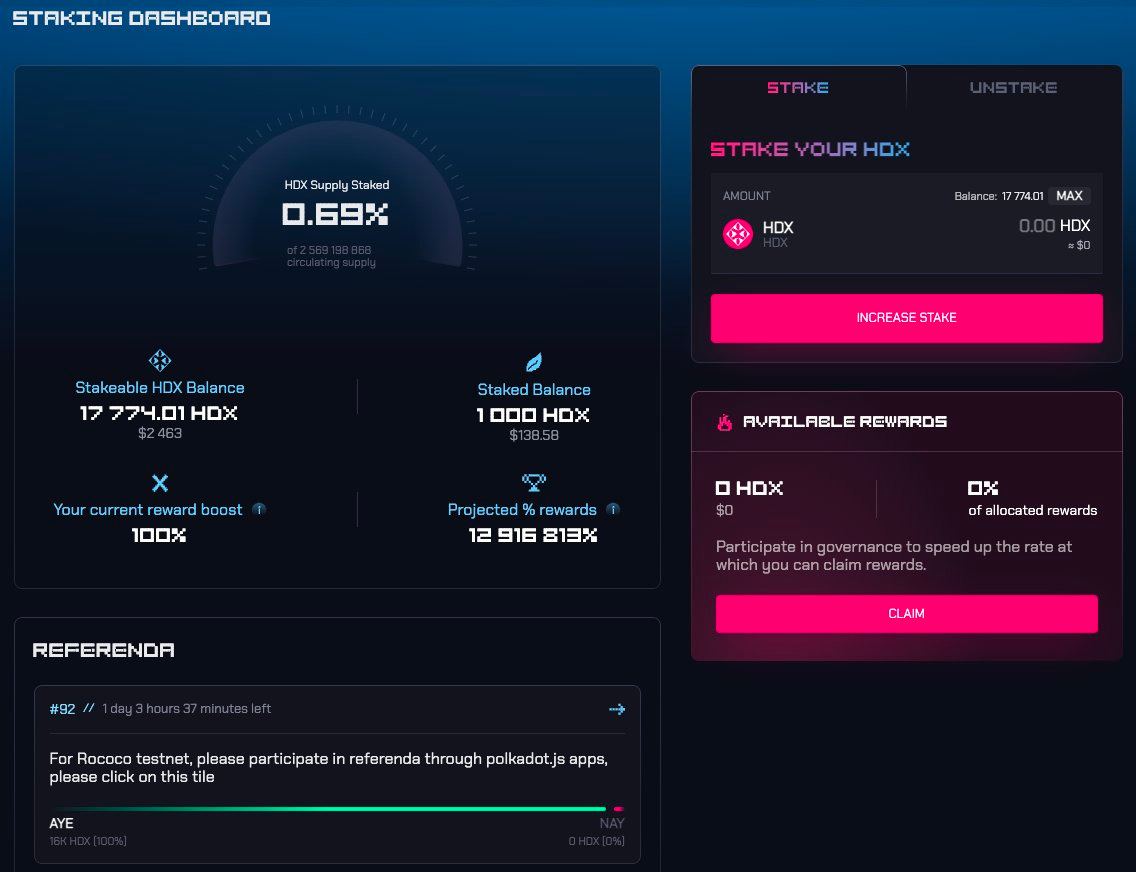

This month, HydraDX launched its long-awaited HDX staking program, incentivizing user activity that benefits the Protocol. HDX holders can now stake their tokens and earn rewards distributed from a dedicated pot filled by protocol revenue streams like LP fees from HDX traded in the Omnipool. An additional 22M HDX subsidy from the treasury also supports APR in the first year.

Staked HDX rewards accrue over time and cannot be instantly claimed in full. Instead, rewards vest along a dynamic bonding curve, encouraging long-term staking. Passive stakers may wait ~2 years to claim 95% of rewards, while active stakers earning maximum action points could claim 95% in just over 2 months. To switch from passive to active staking, stakers can increase their pace of claiming rewards by participating in the governance of HydraDX by voting on community referenda using the staked HDX.

Try out staking and support HydraDX today 🫵 : https://app.hydradx.io/staking

GLMR and vDOT joins the Omnipool

We're delighted to have listed GLMR, another top parachain project on Polkadot, and vDOT, providing liquidity to evermore ecosystem assets in a completely trustless and decentralized manner.

GLMR was provided trustlessly from the Moonbeam treasury via XCM. Click here to learn about the discussion and referendum.

vDOT was minted by HydraDX from the Bifrost protocol trustlessly via XCM. Click here to learn about the referendum.

GLMR is the token of the @MoonbeamNetwork protocol, a smart contract platform for cross-chain connected applications that unites functionality from Ethereum, @Polkadot, and beyond.

vDOT is the liquid staking version of Polkadot created by @BifrostFinance which converts a PoS token to vToken to obtain staking liquidity and rewards synchronously.

Space Monkeys | Kusamarian Podcast Interview

Our CTO Jakub Panik, @cl0w5, and @lolmcshizz had the opportunity to discuss the latest DEX features on HydraDX and moar with the Kusamarian during Polkadot Decoded this year. You can find a recording of the podcast here: https://twitter.com/hydra_dx/status/1691039035920101376?s=20

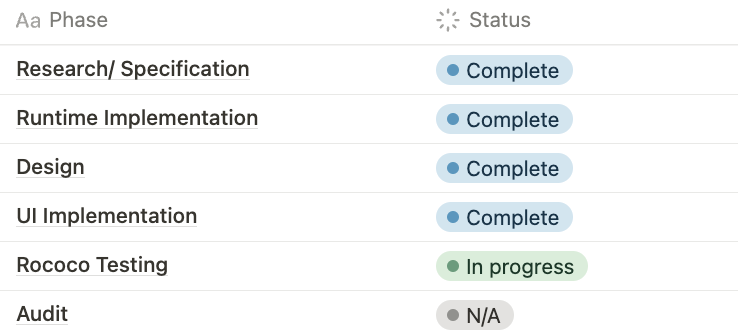

Development Progress Hub

An overview of the status of several selected items and features which are relevant to the HydraDX Protocol.

Partnerships / Business Integrations / Operations

Polkadot Treasury LPs (aka. Hydrate Your Treasury)

Partnering with Polkadot parachains to deploy part of their token supply into the HydraDX Omnipool as an LP. This offers other protocols a cost-effective strategy for market making while helping strengthen the position of the HydraDX Protocol as the go-to ocean of liquidity in Polkadot.

Onboarded Zeitgeist, ASTAR, Centrifuge, Bifrost, Moonbeam

Product Features / Cross-chain / Infrastructure

HDX Staking

SHIPPED ✅

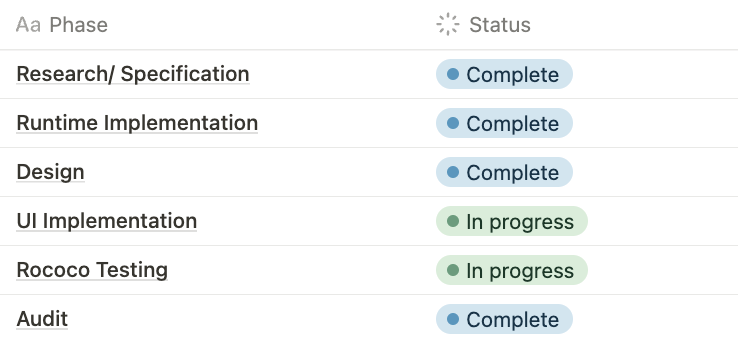

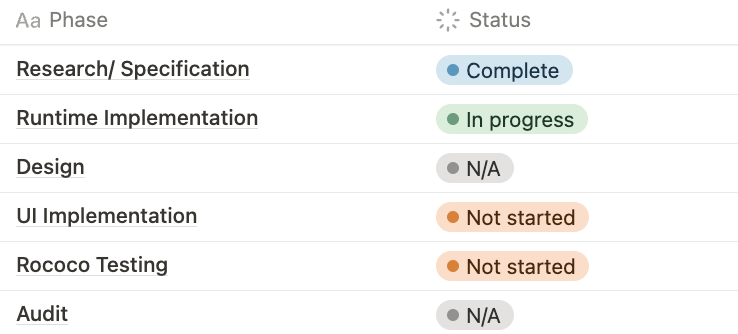

Stableswap Pools

Pallet: https://github.com/galacticcouncil/HydraDX-node/tree/master/pallets/stableswap

Description: This feature allows for creation of Stableswap Pools - closely pegged assets traded based on a different invariant curve (similar to Curve Protocol) - within the Omnipool. This is most ideal for stablecoins.

Notes:

Stablepools implemented into trade router including DCA.

Final testing underway including last tweaks to UI.

Runtime upgrade for mainnet imminent and launch of first pools to follow based on USDC (native) OTC order and ongoing discussion #106.

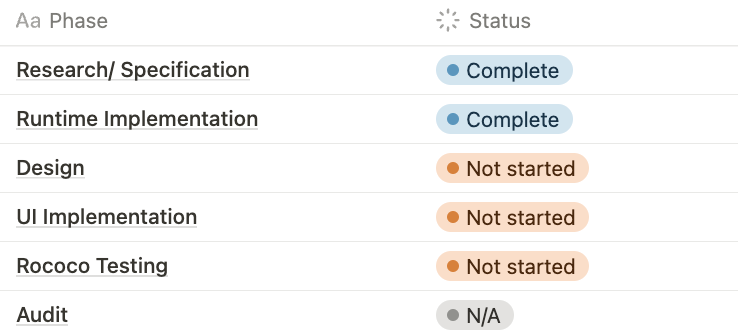

Permissionless Asset Registry

PR: https://github.com/galacticcouncil/HydraDX-node/pull/655

Description: Allowing new assets to be added to the Asset Registry without requiring them to be added through governance - a key component to unlocking maximum degeneracy on Polkadot.

Notes:

Runtime implementation complete, review ongoing.

Will initially launch on Basilisk for testing of permissionless asset registry combined with XYK pools.

Design and UI implementation pending.

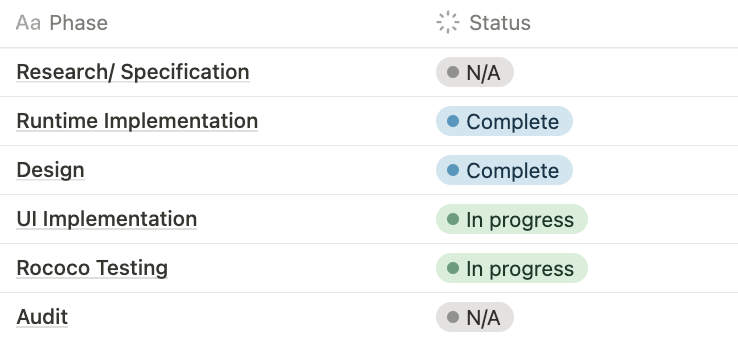

XYK Pools

PR: https://github.com/galacticcouncil/HydraDX-node/pull/664

Description: Implementing XYK pallet from Basilisk onto HydraDX, allowing permissionless trading pool creation. There is growing demand for new assets to be listed on HydraDX, many of which do not yet meet the distribution and price discovery requirements to be added to the Omnipool - XYK pools can serve these early stage assets.

Notes:

XYK pallet deployed on rococo - mainnet to follow in next runtime upgrade.

UI implementation ongoing.

LBP

Pallet: https://github.com/galacticcouncil/HydraDX-node/tree/master/pallets/lbp

Description: Implementing LBP pallet from Basilisk onto HydraDX, allowing price discovery on HydraDX for the entire Polkadot ecosystem. The LBP pallet will also be used as the initial distribution method for HDX Bonds.

Notes:

LBP pallet deployed on mainnet.

Design & UI implementation ongoing.

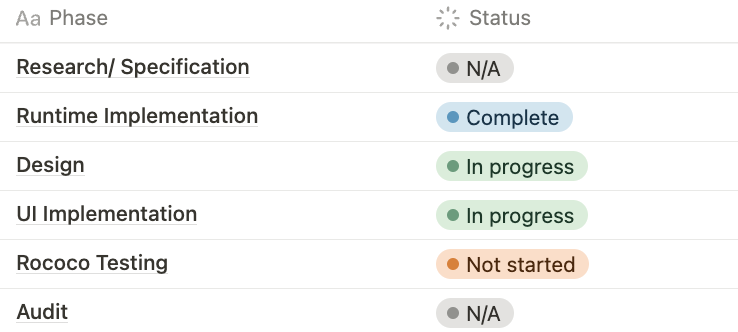

EVM Support

PR: https://github.com/galacticcouncil/HydraDX-node/pull/646

Description: Implementing Frontier pallets by Moonbeam - enabling support for EVM and therefore MetaMask wallet and Ledger.

Notes:

Final development tasks underway - pending final review.

Bonds

Pallet: https://github.com/galacticcouncil/HydraDX-node/tree/master/pallets/bonds

Description: This feature allows for HDX to be sold as bonds, locked and vested over a pre-determined period of time. Proceeds of bonds sales will be sent to the Treasury as Protocol owned Liquidity (POL).

Notes:

Pallet live on mainnet.

Final testing underway in UI ahead of full launch.

Other developments

Next-gen XCM UI

Utilising MRL to bridge Ethereum ERC-20s directly to HydraDX within our CROSS-CHAIN UI

Support for cross-chain swaps (XCM Exchange use-case)

Governance Square

A selection of recent governance proposals. Proposals where vote totals/controversy are not discussed can generally be assumed to have passed overwhelmingly (>90% non-abstaining vote).*

Proposals/ In Discussion

Discussion #119 - Add INTR to HydraDX (Omnipool)

Discussion #116 - Intergalactic Limited 6 months development funding - second tranche

Discussion #106 - Diversification of MRL DAI

Passed

Ref #79 - Suspend WBTC (Acala), add & remove liquidity, create OTC order [Phase 5]

Ref #78 - Add & remove liquidity, create OTC orders [Phase 4]

Ref #77 - Add GLMR to Omnipool [CORRECT]

Ref #75 - Withdraw 2x LPs & create 2x OTC orders [Phase 3]

Ref #74 - Add additional WBTC, WETH & DAI (MRL) to the Omnipool

Ref #73 - Mint additional vDOT & add to Omnipool

Ref #72 - Proposal to Issue Assets for Erroneous Transactions

Ref #71 - Create OTC for USDC native

Ref #70 - Add HDX to Omnipool & decrease weight cap

Ref #69 - Withdraw 3x LPs & create 3x OTC orders [Phase 2]

Ref #68 - Add vDOT to Omnipool

Ref #67 - Initialise staking & subsidise rewards for 1 year

Ref #66 - Mint vDOT directly from HydraDX using XCM

Ref #65 - Runtime upgrade release v19

Ref #64 - Add liquidity to Omnipool & initiate DOT DCA round 5

Ref #63 - Redistribute HDX crowdloan rewards (Bifrost)

HydraDX Basics

About HydraDX

HydraDX is a next-gen DeFi protocol which is designed to bring an ocean of liquidity to Polkadot. Our tool for the job the HydraDX Omnipool - an innovative Automated Market Maker (AMM) which unlocks unparalleled efficiencies by combining all assets in a single trading pool. Besides more efficient trading, the Omnipool design enables single-sided LPing. Visit the HydraDX website to find out more.

Twitter | Discord | Telegram | Youtube | Newsletter | Monthly Updates (archive)