HydraDX Monthly Update - July 2023

Dynamic Fees, Split Trade (simple DCA), Audits Bounty for Polkadot

Welcome to the HydraDX Monthly Update, where you can keep track of all things HydraDX.

Organizational update: We will be shifting the monthly Office Hours and AMA sessions to a quarterly format. The upcoming sessions will be held in early October.

Greetings! Stepping into the vibrant month of August, we hope you're enjoying the summer vibes. The crypto world continues to evolve, and here at HydraDX, we're fully committed to staying ahead of the curve.

Before moving on to the July monthly update, we would like to share with you our new video which digests the most important mechanics of the HydraDX Omnipool in just under 2min. Check it out here:

This month we're excited to announce the launch of our latest feature, Dynamic Fees. This innovative addition adjusts trading fees based on market volatility, ensuring a more efficient and adaptive liquidity management approach that mitigates the negative effects of impermanent loss on LPs.

Furthermore, the HydraDX governance recently approved placing a DCA order from the Treasury for buying HDX worth up to $1M. This move aims to strengthen the growth budget of the Protocol, which will be strategically redeployed in the future.

An exciting feature has just hit our Rococo testnet - Split Trade. This simple implementation of DCA allows users to easily reduce the slippage of their orders by splitting them into multiple smaller traders.

On a broader ecosystem level, the Polkadot governance recently approved one of our flagship initiatives - the Polkadot Assurance Legion. The bounty of 540,000 DOT will soon start flowing into the eco to strengthen the audit capabilities in Polkadot.

Finally, at the end of this post, you will find a comprehensive status update touching upon all exciting features which are currently in our pipeline.

We always appreciate your feedback and suggestions on how we can improve. Feel free to drop us a comment in Discord.

Without further adieu, let’s dive into this month’s updates!

Key Protocol Updates

Dynamic Fees [LIVE]

HydraDX is thrilled to unveil an exciting new feature: Dynamic Fees, addressing the complexity of providing liquidity in the DeFi space. With the aim of limiting exposure to impermanent loss during times of heightened volatility, trading fees now adjust based on observed market volatility.

This feature is made possible through the implementation of Decaying Average Oracles, which measure the intensity and duration of price movements. As a result, fees can increase or decrease in alignment with market conditions, ensuring a more efficient and adaptive approach to liquidity management for HydraDX users.

To maintain a fair and balanced fee structure, a maximum fee cap of 0.45% has been implemented to prevent fees from becoming disproportionate at this time. HydraDX's Dynamic Fees represent a significant step forward in optimising the returns for liquidity providers and enhancing the overall DeFi experience.

Try it out here!

$1M Treasury DCA Order [LIVE]

Exciting news for HDX holders! The protocol’s governance has recently given the green light to a proposal that allows the treasury to initiate a buyback of up to $1 million worth of HDX tokens. This strategic move is a crucial step in strengthening the growth budget and paving the way for future initiatives, including the highly anticipated Bonds.

By repurchasing HDX tokens, HydraDX aims to bolster its financial resources and create a solid foundation for upcoming developments. This buyback demonstrates the protocol’s commitment to long-term sustainability of the HDX token.

For those eager to stay updated, HydraDX encourages interested individuals to observe the governance referenda, which have already approved three separate Treasury DCA orders. You can view ongoing referenda directly in the UI of the HydraDX app.

Treasury DCA referenda 👉 Ref #51, Ref #52, Ref #55

Split Trade (simple DCA) [TESTNET]

As a follow up to HydraDX DCA which was released last month, users will soon be able to quickly set up a DCA order from the trade screen using Split Trade. While the full DCA feature allows users to fine-tune their DCA strategy, Split Trade helps protect traders against slippage by splitting the order into many small trades which are executed over a (shorter) timespan.

The feature can be previewed on Testnet: https://rococo-app.hydradx.io/#/trade

Polkadot Assurance Legion [APPROVED]

The Polkadot Assurance Legion - one of the flagship ecosystem initiatives spearheaded by the HydraDX Protocol, has been approved by the governance of Polkadot. In the upcoming months, 540,000 DOT will flow into the wider eco to help audit some critical pieces of infrastructure and make Substrate and ink! audits more accessible (and less expensive). Besides more security for Polkadot, one of the goals of PAL is to make our ecosystem more attractive to new builders.

Once the bounty becomes operational, the HydraDX team is planning to apply for a grant to conduct a large-scale, crowd-sourced audit of the Omnipool and its supporting functionalities (e.g. Stableswap and oracles), with a special focus on DeFi exploitability.

Check out the proposal 👉 https://polkadot.polkassembly.io/referenda/47

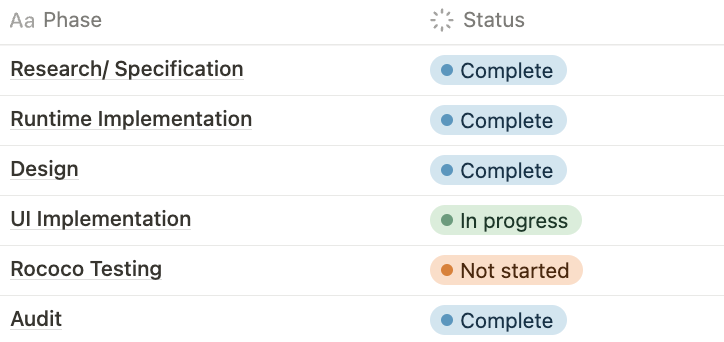

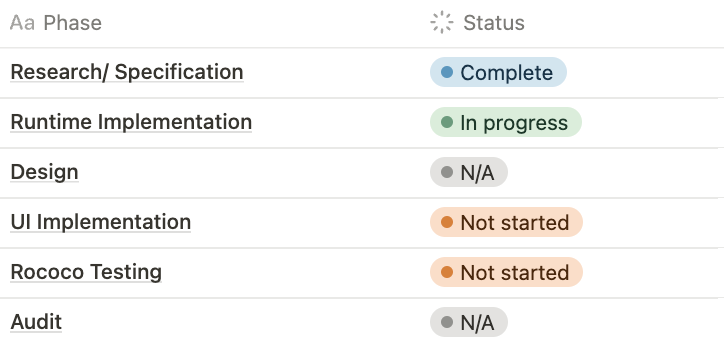

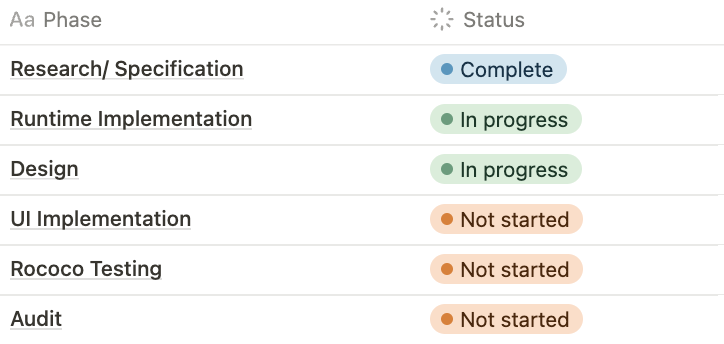

Development Progress Hub

An overview of the status of several selected items and features which are relevant to the HydraDX Protocol.

Partnerships / Business Integrations / Operations

Polkadot Parachain LPs (aka Hydrate Your Treasury)

Partnering with Polkadot parachains to deploy part of their token supply into the HydraDX Omnipool as an LP. This offers other protocols a cost-effective strategy for market making while helping strengthen the position of HydraDX as the go-to ocean of liquidity in Polkadot.

Onboarded Zeitgeist, ASTAR, Centrifuge.

Bifrost governance proposal in vote:

https://bifrost-polkadot.subsquare.io/democracy/referendum/59Moonbeam governance proposal in discussion: https://forum.moonbeam.foundation/t/proposal-xx-proposal-to-list-glmr-on-the-hydradx-omnipool/893

Product Features / Cross-chain / Infrastructure

We have added the following features into the development pipeline: 1) Permissionless Asset Registry, 2) XYK Pools, 3) LBP, 4) EVM Support, 5) Bonds. The features DCA and Liquidity Mining have been removed as they are fully completed.

Dynamic Fees

SHIPPED ✅

XCM Rate Limiter

SHIPPED ✅

Stableswap Pools

Pallet: https://github.com/galacticcouncil/HydraDX-node/tree/master/pallets/stableswap

Description: This feature allows for creation of Stableswap Pools - closely pegged assets traded based on a different invariant curve (similar to Curve Protocol) - within the Omnipool. This is most ideal of stablecoins and liquid staking derivatives (i.e. stDOT).

Notes:

UI implementation ongoing.

HDX Staking

PR: https://github.com/galacticcouncil/HydraDX-node/pull/639

Description: Non-inflationary staking mechanism for HDX to secure the network from potential malicious governance activity. Yields for HDX stakers will be generated from on-chain activity - other factors such as time locked and governance participation will impact individual reward rates.

Notes:

Runtime implementation ongoing.

Design complete.

UI implementation ongoing.

Permissionless Asset Registry

Description: Allowing new assets to be added to the Asset Registry without requiring them to be added through governance - a key component of Operation Shitcoin Casino, unlocking maximum degeneracy on Polkadot.

Notes:

Initial feature discovery complete.

Runtime specification ongoing.

XYK Pools

Description: Implementing XYK pallet from Basilisk onto HydraDX, allowing permissionless trading pool creation as part of Operation Shitcoin Casino. There is growing demand for new assets to be listed on HydraDX, many of which do not yet meet the distribution and price discovery requirements to be added to the Omnipool - XYK pools can serve these early stage assets.

Notes:

Initial feature discovery complete.

LBP

Description: Implementing LBP pallet from Basilisk onto HydraDX, allowing price discovery on HydraDX for the entire Polkadot ecosystem. The LBP pallet will also be used as the initial distribution method for HDX Bonds.

Notes:

Initial feature discovery complete.

EVM Support

PR: https://github.com/galacticcouncil/HydraDX-node/pull/646

Description: Implementing Frontier pallets by Moonbeam - enabling support for EVM and therefore MetaMask wallet and Ledger.

Notes:

Implementation into the HydraDX Runtime and node ongoing.

UI implementation is being planned.

Bonds

PR: https://github.com/galacticcouncil/HydraDX-node/pull/645

Description: This feature allows for HDX to be sold as bonds, locked and vested over a pre-determined period of time. Proceeds of bonds sales will be sent to the Treasury as Protocol owned Liquidity (POL).

Notes:

Initial discovery & runtime specification complete.

Runtime implementation ongoing.

Design ongoing.

Other developments

Development of API infrastructure to provide data such as Omnipool pricing to e.g. CoinGecko HydraDX API

Submitted to CoinGecko for review ⏳

Next-gen XCM UI

Support for cross-chain swaps (XCM Exchange use-case)

Governance Square

A selection of recent governance proposals. Proposals where vote totals/controversy are not discussed can generally be assumed to have passed overwhelmingly (>90% non-abstaining vote).*

Proposals/ In Discussion

N/A

Passed

Ref #56 - Runtime upgrade to v18.0.0

Ref #55 - Initiate the third Treasury DCA orders

Ref #54 - Add iBTC & DOT liquidity to Omnipool

Ref #53 - Add CFG to the Omnipool

DOT+Ecosystem Partners News

HydraDX Basics

About HydraDX

HydraDX is a next-gen DeFi protocol which is designed to bring an ocean of liquidity to Polkadot. Our tool for the job the HydraDX Omnipool - an innovative Automated Market Maker (AMM) which unlocks unparalleled efficiencies by combining all assets in a single trading pool. Besides more efficient trading, the Omnipool design enables single-sided LPing. Visit the HydraDX website to find out more.

Twitter | Discord | Telegram | Newsletter | Monthly Updates (archive) | Youtube